will advance child tax credit payments continue in 2022

Child tax credit payments in 2022 will revert to the original amount prior to the pandemic. In january 2022 the irs will send.

Irs Tax Letters 2022 What Do The Letters Expected To Arrive Soon Mean For You Marca

For the first time since july families are not expected to receive a 300 payment on january 15 2022.

. President Biden wants to continue the child tax credit payments in 2022. Couples must earn 150000 or less to qualify while the cap is 75000 for individuals. However if Congress doesnt approve President Bidens proposed modifications as part of the Build Back Better plan the program will revert to its original form.

The advance Child Tax Credit payments that were sent out last year have officially come to an end. The advance payments are 50 of the credit youre expected to qualify for when you file your 2021 tax return. Key points While last years monthly Child.

Parents get the remaining child tax credit on their 2021 tax returns. The child tax credit will continue in some form. And while the final monthly payment of 2021 went out Dec.

In 2022 you can qualify for the full 2000 child tax credit if your MAGI is below 200000 for single filers or 400000 for joint filers. Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of. 15 there is still more of that money coming to Americans in 2022.

When is the next Child Tax Credit payment due. Heres what you should know about the push for more benefits. Its a mechanism for distributing the tax burden based on ability to pay.

The expansions also lowered food insecurity rates helped families afford necessities and reduced financial stress for parentsBut since the. See the instructions for schedule 8812 form 1040 pdf. To be eligible for the full child tax credit single parents must have a modified adjusted gross income under 75000 per year.

It isnt considered taxable income and it wont affect any government benefits. This blog was updated on May 24 2022. 15 there is still more of that money coming to Americans in 2022.

The Child Tax Credit in 2022 isnt going away per se. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes a. Those parents who received the advance payments over the second half of.

2021 Child Tax Credit And Advance Child Tax Credit Payments. The child tax credit will continue in some form. Whether that includes monthly payments and how many parents will be eligible will be up to Congress.

The temporary expansions to the Child Tax Credit CTC dramatically reduced the share of children experiencing poverty in 2021 especially for Black and Latinx kids. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. After those thresholds the credit reduces by the same 50 for every 1000.

Child tax credit payments in 2022 will revert to the original amount prior. While low- to moderate-income parents across the nation came to rely on the early tax payments. Child Tax Credit Payment Schedule 2022.

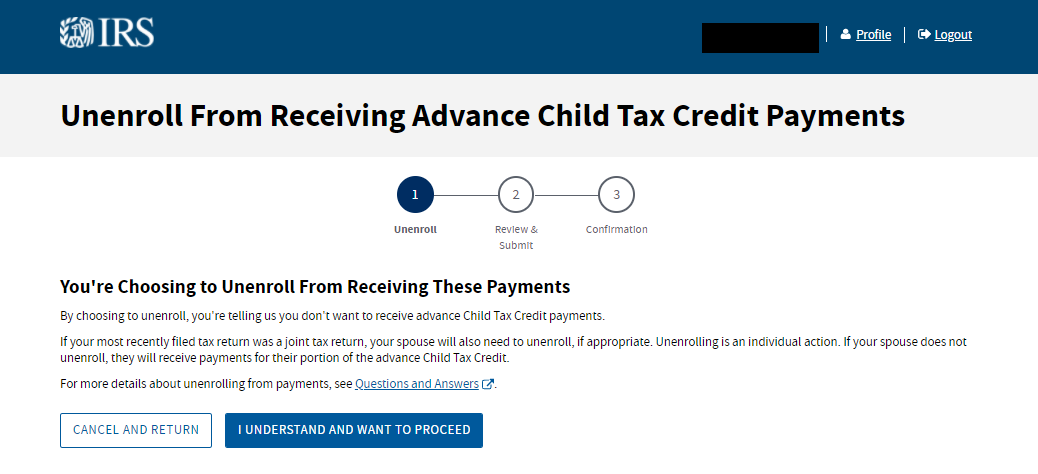

Irs started child tax credit ctc portal to get advance payments of 2021 taxes. The JCT has made estimates that the TCJA changes. The Child Tax Credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021.

But Things Will Change Again When You File Your 2022 Return As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to. But during the development of the child tax credit there was also a recommendation from the National Commission on Children to introduce a child tax credit that was 1000 per child and fully refundable. However Congress had to.

There will no longer be advance payments of the credit. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child.

Unfortunately the previous version is much less generous to American families. This final payment of up to 1800 or up to 1500 is due out in April of 2022. In fact the boosted Child Tax Credit is pretty much off the table for 2022 as lawmakers were unable to pass a spending bill that allowed.

In fact he wants to try to make those payments last for years to come all the way through 2025. That effort took a significant turn on Sunday. If the total of your advance Child Tax Credit payments is greater than the Child Tax Credit amount that you are allowed to claim on your 2021 tax return you may have to repay the excess amount on your 2021 tax return during the 2022 tax filing season.

The future of the child tax credit advance payments scheme remains unknown. In 1996 when the credit was first enacted it was 500 per child. For example if you received advance Child Tax Credit payments for two.

29 What Happens With The Child Tax Credit Payments After December. And while the final monthly payment of 2021 went out Dec. Lawmakers havent given up on the fight for more expanded Child Tax Credit payments in 2022.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Thousands Of Illinois Families Could Miss Out On Monthly Child Tax Credit Payments

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Season 2022 How Much Is The Tax Payment Per Child For This Year Marca

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

How To Report Advance Child Tax Credit Payments On Your 2021 Tax Return Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Get Child Tax Credit Payments If You Don T File A Tax Return Kiplinger

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23423273/AP21196663764782.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

One Child Tax Credit Payment Cut Financial Anxiety For 56 Of Families

There S A Catch To Qualify For Advance Child Tax Credit Checks Everything To Know Cnet